Published on 12 December 2022

Energy Market Update: Upstream

Published on 12 December 2022

Further to our commentary at the beginning of 2022, it certainly holds true that the market has divided into distinct profiles of risk for upstream energy business.

Where at the end of 2021 the larger NOCs / IOCs offshore were receiving flat to low single digit renewal rate rises, many of the higher profile and well performing insured’s in this arena are now enjoying small rate reductions. This however is in contrast to the small to mid-market onshore element of the London upstream portfolio which continues to draw average rate rises in region of +7.5%.

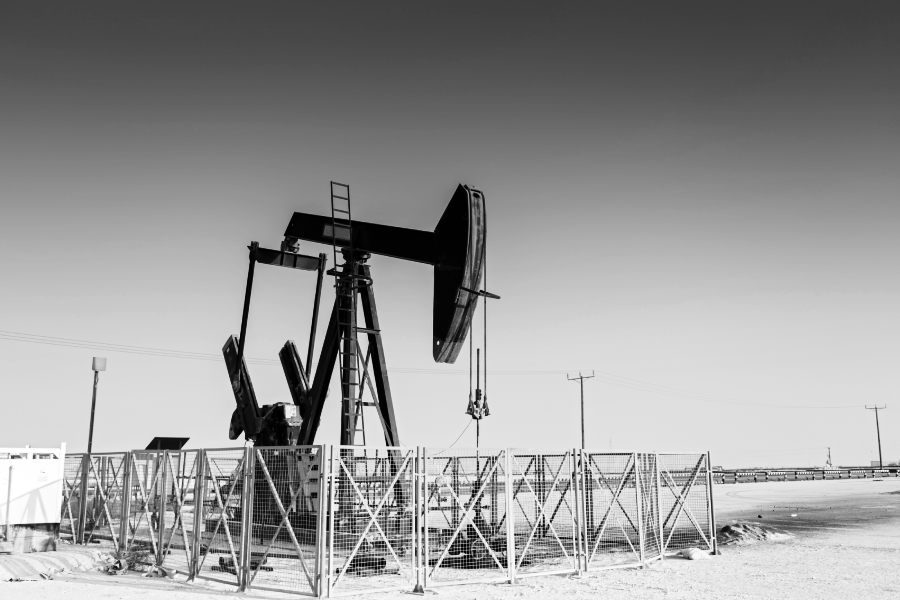

There are a number of specific coverages which are seeing even larger rate increases and these include onshore Control of Well, Loss of Production Income (LOPI) / Business Interruption (BI) / Contingent Business Interruption (CBI), Frac spreads within the onshore Land Rig space and Salt Water Disposal (SWD) facilities. These increases are generally as a result of increased loss activity with Frac spreads being particularly susceptible to the fire & explosion perils (given the proximity of the Frac units on each of the sites).

We have seen a clear reduction in available capacity for Frac spreads in the London market and this is despite an increase in domestic competition from the local carriers. SWD facilities have remained difficult for a number of years now and this is due to lightning and static discharge perils. Some London markets will offer limited coverage when adequate lightning protection systems are in place and if the accounts carry high retentions or high AADs.

The most prominent news in respect of capacity updates is that of Munich Re Syndicate withdrawing their USD250m of capacity from the upstream space with effect from 1st January 2023.

The implication of this withdrawal will be interesting to observe as many leading syndicates are receiving Lloyd’s approval to increase their capacity in 2023 which will no doubt result in increased competition amongst the second tier lead markets to step up and undertake Munich Re’s leadership position in the market.

Despite the Munich Re withdrawal, we still believe that there is ample capacity for the large majority of upstream risks; however, it’s very likely that the single greatest impact of Munich Re’s withdrawal will be felt within the Gulf of Mexico, Named Wind Storm portfolio. This is on the basis that Munich Re has been the historical leader on this sub-class of energy business.

Matt Byatt

Matt began his career at the JLT Group specialising in energy package programmes with a strong emphasis on North American business. After 14 years, Matt moved to Alesco with a significant development role in terms of new business, placing and implementation of complex programmes worldwide. Matt’s extensive international Upstream marketing and placement experience aligns with clients’ needs, and he will work closely with his broking colleagues and our servicing team, including claims when the situation arises.