Published on 13 April 2023

The Domino Effect

Published on 13 April 2023

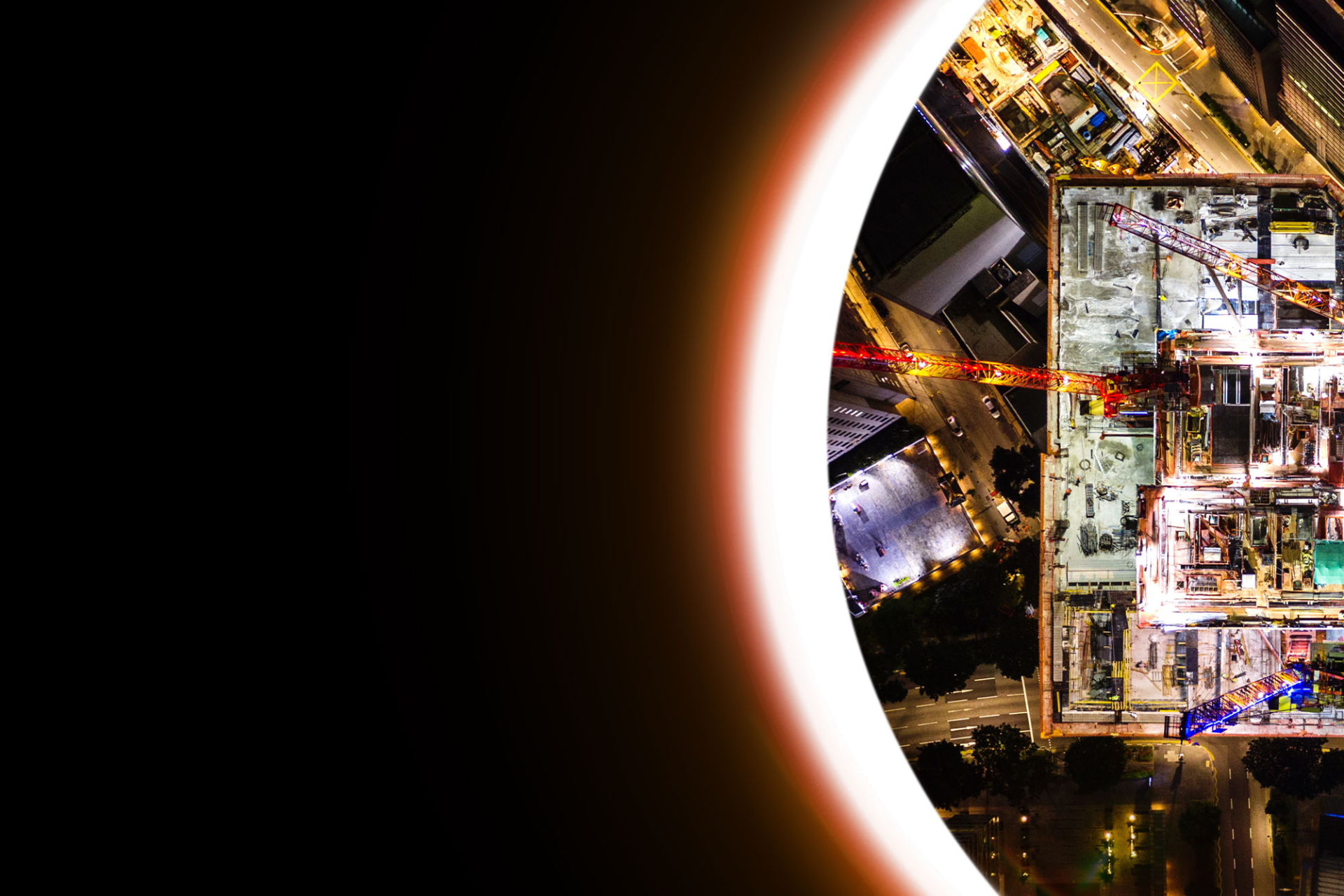

A delayed start to a building project can herald an unwelcome domino effect that disrupts the whole schedule.

After unparalleled economic upheaval, the US construction industry’s operations are beset by numerous challenges. While the COVID-19 pandemic may be perceived in the rear-view by many, labor shortages persist. There may be plenty of work to bid for, but inflation continues to hammer profitability. Many projects did not commence or were delayed last year because costs were eye-wateringly higher than anticipated.

At face value, these hold-ups are frustrating, but they also have an unwelcome knock-on effect: project delays can cause insurance policies to expire. Obtaining cover when delays are ongoing is becoming increasingly difficult; domestic insurers are walking away from risks, leaving contractors with two options: look for cover further afield, or self-insure, which could break any lender agreement in place.

A Labored Issue

Along with vying with other industries for talent, the 2008 economic recession’s legacy for construction is a smaller talent pool and an aging workforce — one in five workers is currently older than 55.

During the Great Recession, the US construction industry dismissed over a quarter (28%) of its workforce. The recession lasted 18 months, but the construction industry and wider economy felt its effects for far longer. Consequently, many workers never returned, and the industry’s current image does not necessarily appeal to the younger demographic, despite ongoing marketing campaigns.

The construction sector has yet to recover to pre-2008 levels of activity; however, it has grown in recent years – building permits in 2018 and 2019 hit a five-year high. The US construction industry comprises more than 650,000 employers, over six million employees and almost USD1tn in annual business.

Nevertheless, lack of skilled labor is now the number one cause of loss in subcontractor defaults. When boots on the ground are in short supply, budgets and projects overrun, delays are scheduled, and excessive overtime creates an increased safety risk.

Technology boosts cross-sector efficiency and has been harnessed by contractors in the form of advanced modeling, project planning and scheduling software and use of automatic equipment and drones. However, digitalization and innovation will only remain pieces of the puzzle.

The Complexities of Supply and Demand

The Associated Builders and Contractors' (ABC) Construction Backlog Indicator (CBI) increased to 9.2 months in November last year, according to an ABC member survey. The reading is 0.8 months higher than in November 2021. The CBI is now at its highest level since the second quarter of 2019. Contractors with under USD30m in revenue are largely responsible for the increase in backlog and now enjoy their highest level of backlog in over three years.

Builders desperate to keep pace with the post-COVID-19 real estate boom bumped construction worker pay up at the fastest rate in 40 years to counter the skilled labor shortages. The construction industry overall added 60,000 jobs, and wages for non-supervisory positions saw the fastest growth rate in 40 years, according to the US Bureau of Labor Statistics.

Yet sentiment is low in the residential market. The US housing market’s recession began in June last year, according to National Association of Housebuilders (NAHB). In January 2022, the NAHB/Well Fargo housing market index was 83, but it had plummeted to 31 by December.

While housebuilders want to offer buyers affordable housing, construction prices jumped 30% in 2022, and a third of respondents to a recent NAHB survey said they had difficulties sourcing electrical transformers – a vital component in residential construction. One glimmer of hope is that December marked the smallest drop all year – hinting that the market could be turning a corner.

Despite the market’s challenges, experts predict a long-term trend for growth in residential construction. It is estimated that five million homes must be built this year to meet house buyer demand.

Inflationary Pressure

While the US appears to be entering a period of diminishing inflationary pressure, buildings market inflation hit a painful 40-year high in June last year and has caused long-term consequences. Construction material prices rose 20% between January 2021 and January 2022, according to analysis of government data by the Associated General Contractors of America (AGC). Material prices remain volatile – lumber and plywood were the main concern early last year, but cement and diesel costs are now the source of most headaches. Price instability makes it difficult for contractors to plan projects and allocate budget accordingly.

Supply chain-related disruptions should begin to ease, but the ongoing global labor shortfall will hinder production and logistics capacity. As a result, long lead times and material shortages will likely continue in the short term.

In November 2021, President Biden’s Infrastructure Bill included USD550bn in new road, rail and broadband funding, but inflation has forced states to cancel or delay projects as costs continue to balloon.

One pertinent example is a roadway project underway in Raleigh, North Carolina. The project’s original budget was set at USD31m to widen sidewalks, add separated bike lanes and enhance transit infrastructure to a 2.3-mile stretch of road. Yet, since 2017, costs have jumped by 70%, and construction has been delayed by almost a year. Improvements along the Raleigh beltline were initially scheduled to take four years and finish in June 2023. Now, the project is not expected to be complete until October 2024.

A Hard Market Solution

A delayed start to a building project can herald an unwelcome domino effect that disrupts the whole schedule. Post-pandemic, contractors managing delayed construction projects have been scrambling to extend their insurance programs in the face of hard market conditions.

In contrast to London, it’s not uncommon to see limited or no automatic extension provisions on US forms, and the vast majority of projects currently underway were underwritten when terms were much softer. Therefore, when coverage deadlines are reached, with the economic uncertainty and absence of any contractual obligation to remain until completion, many domestic insurers are simply walking away. Those that remain are taking drastic action: raising rates, deductibles and self-insured retentions, while reducing coverage available.

Consequently, firms seeking to extend a project coverage expiration date face some tough decisions. Most are already struggling due to supply chain woes and inflationary pressures, and most likely have not factored in increased insurance costs midway through the process.

Alesco recognizes the potential problems this may cause US brokers when trying to arrange extensions for clients’ builders’ risk policies. We have created a union of A-rated carriers to provide a solution to support mid-term extensions for combustible projects worth over USD10m and non-combustible builds with a minimum value of USD15m.

In the current climate, Alesco has been asked to place mid-term extensions for various high-value frame residential projects in California. In one recent example, we successfully secured USD20m in coverage for the project, which was roughly 60% complete. The domestic insurer refused to the extend coverage, and the client needed adequate insurance in place to satisfy its lender requirements. We were able to replace 100% of the domestic capacity with London capacity for a one-year extension at competitive terms, subject to terms and conditions.

In another pertinent case, a contractor with 10 years’ experience and a clean loss record had commenced building two non-combustible towers in Florida in 2018. Despite the project being 98% complete, fully sealed with sprinklers and fire alarms fully operational, the contractor could not extend cover in the US market. Again, Alesco secured 100% capacity in the London market for a five-month extension meaning the project could be seen through to completion.

Brian Denney

Brian has 32 years of specific construction experience and specialises in the design, placement and servicing of insurance programmes for clients globally. Brian’s expertise is in infrastructure risks and has extensive experience in risk management and the specific insurance requirements of large and complex civil construction projects including tunnels, bridges and roads procured through both the public and private sector. The PPP nature of many of these projects has led to a broad experience of structured finance projects.